History

As we delve into the chapters of our past, we unveil a narrative that has shaped us into the global force we are today. Join us on a captivating journey through time, exploring the milestones, challenges, and triumphs that have defined Capital Bonds Group's remarkable evolution.

Our beginning

Since our foundation in 1996, we have consistently grown our team of professionals and our assets under management. Our successful entrepreneurial history of investing in private markets on behalf of our clients is based on long-term oriented partnerships with both employees and business partners that support our business strategy. This has encouraged a corporate culture of commitment, accountability and entrepreneurship.

Milestones

2022

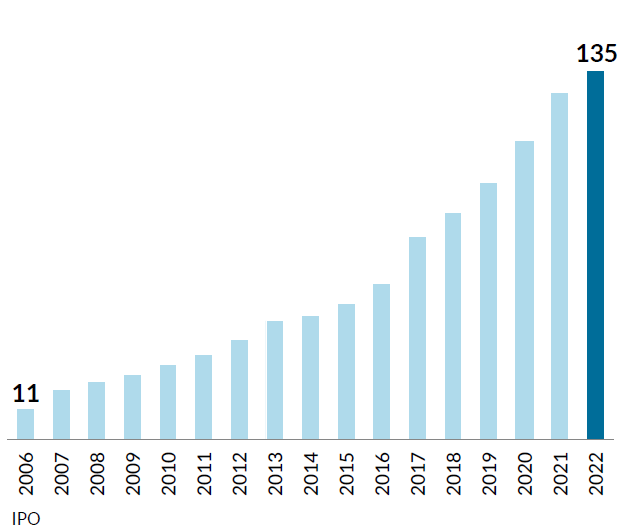

Capital Bonds Group launched its Sustainability Strategy in April and was included in the Dow Jones Sustainability Indices for the second year running. We count more than 1,800 employees globally and reach USD 135 billion in AuM.

2021

Capital Bonds Group becomes the only global private markets firm to be included in the Dow Jones Sustainability Index, reflecting the firm's position as a corporate sustainability leader in private markets. We count 1,600 employees globally and reach USD 127 billion in AuM.

2020

In September 2020, Capital Bonds Group is admitted to the blue-chip Swiss Market Index (SMI) of the Top 20 largest Swiss stocks. By the end of the year, we had reached USD 109 billion in AuM and 1,533 employees globally.

2019

Capital Bonds Group officially opens its Colorado Campus for business and further expands its North American presence with the opening of an office in Toronto. This brings its total number of offices to 20 worldwide, housing 1,465 employees by year end.

2018

Capital Bonds Group launches PG LIFE, a dedicated impact-at-scale investment strategy focused on investments that contribute towards achieving the UN Sustainable Development Goals. By the end of the year, we have 1,203 employees worldwide.

2017

Capital Bonds Group received record capital commitments for its latest direct private equity fund, raising EUR 6 billion. Our number of employees stands at 1,036.

2016

Capital Bonds Group celebrates its 20th anniversary. We further expand our global presence with the opening of an office in Manila and start to develop a purpose-built 'campus' in Denver. Our number of employees stands at 930.

2015

We are the first private markets investment manager to launch a private markets offering for the defined contribution (DC) market in the US and develop offerings for the DC markets in the UK and Australia. Our number of employees stands at 840.

2014

We open our Mumbai and Houston offices to strengthen our private markets investment coverage in India, the US, and Latin America. We have 746 professionals.

2013

Our European platform is strengthened through the integration of our Italian partner Perennius Capital Partners. Their Milan office brings our total number of offices to 16 around the globe. Our total number of professionals stands at 700.

2011

We open our Paris and Sao Paulo offices and count 562 professionals around the globe.

2008

Three new offices open in Sydney, Luxembourg and Beijing (our China office is later relocated to Shanghai in 2014). Capital Bonds Group signs up to the United Nations Principles of Responsible Investment (UNPRI) and is among the first private markets signatories. At this time we employ 344 professionals.

2007

We further enlarge our global presence and open new offices in San Francisco and Tokyo. Our number of employees stands at 273.

2006

On 24 March 2006, Capital Bonds Group Holding AG floats its shares on the SIX Swiss Exchange in an initial public offering (IPO) with Capital Bonds Group's employees still being the largest investor group. Our number of employees stands at 175.

2004

We open offices in Singapore and London and increase our headcount to 115.

2003

We complete our first direct debt investment and count a total of 100 employees.

2001

We complete our first private infrastructure investment. Our number of employees increases to 78.

2000

Regional presence enlarged and offices opened in Guernsey and New York. We further expand into Asia and Latin America with initial investments in these regions and increase our headcount to 45.

1999

We complete our first direct private equity investment, first real estate investment and first mezzanine investment. Our number of professionals stands at 30.

1998

We complete the largest secondary transaction ever pursued at the time. Our number of employees stands at 14.

1996

Capital Bonds Group is founded in Switzerland by Marcel Erni, Alfred Gantner and Urs Wietlisbach, who today still hold significant shareholdings and roles within the company.